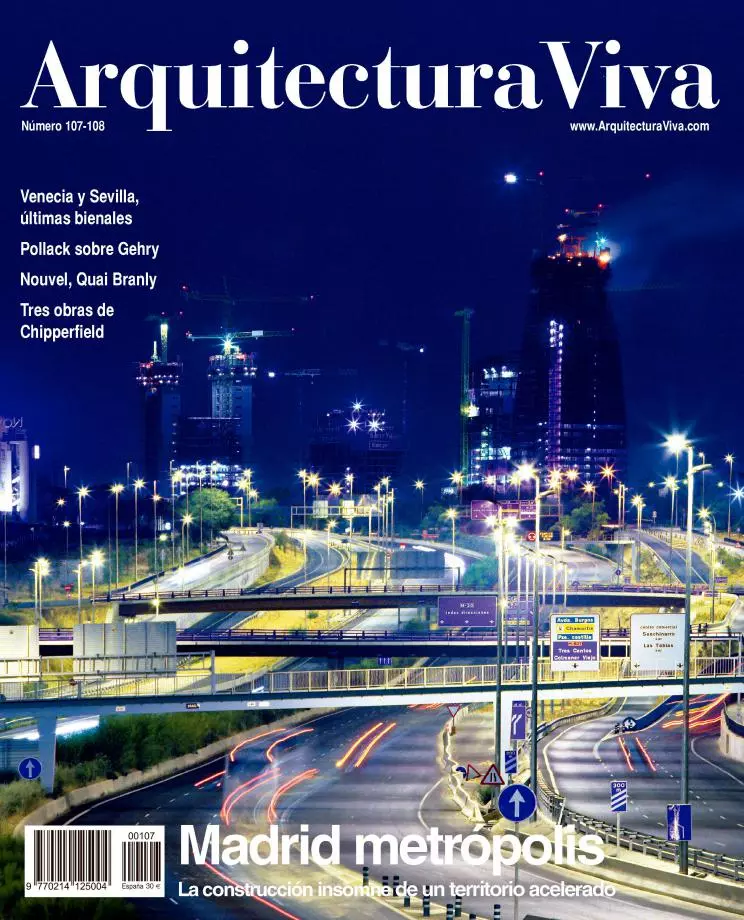

Madrid speeds up because Spain does so. The city’s unchecked growth reflects the unique dynamism of the country’s economy, which has in the capital the headquarters of the main corporations and its most powerful business engine. The rhythm of change is spectacular, and the striking scale of the urban mutation causes at once admiration and anxiety. Without a doubt, the current territorial shoot up stretches to the limit both the material tolerance of the urban grid and the immaterial resistance of the citizens’ patience, but even those most affected by the non-stop metropolitan construction works shall in the end accept the penance of confusion if the alternative to the disorderly energy of this boom is no other than the decline of a shrinking Madrid. Today, vibrating like a rocket under the impulse of its real-estate turbo, the shattered structure of the city breaks apart and comes together again with the ease of its economic fabric.

A study of the ratings agency Standard & Poor’s places Madrid among the five first economic centers of the world, according to a criterion that considers political, social and demographic factors, including development potential. The nine Spanish companies placed among the world’s 500 largest, as sociologist Mauro Guillén has stressed when commenting the list of Fortune, have their headquarters or decision centers in Madrid, giving it the sixth position in a ranking of global cities; the nine firms – Repsol YPF, Santander, Telefónica, Endesa, Cepsa, BBVA, Altadis, ACS and Iberdrola – also operate in sectors of high added value (services, energy and infrastructures), making them more competitive, and this business muscle is significantly reinforced with the frequent establishment in Madrid of the Latin American head offices of European multinationals, as well as of the European management centers of institutions and companies of Latin America.

This continent was the target of the first wave of Spanish acquisitions, which summed up 80,000 million euros between 1992 and 2001; the second period of acquisitions, centered on Great Britain (including O2, Abbey, BBA and Scottish Power), already adds up 83,000 million euros; and on the horizon one can already make out a third wave focussed on China, where Telefónica and BBVA have important buys under way. Such expansionist drive can be explained, according to The Financial Times, by the strength of an economy whose recent growth surpasses fourfold that of Germany, while the population increases with colossal migratory flows. This surge of human and monetary metabolism lies at the base of Madrid’s building vitality, and perhaps only a sudden burst of the real-estate bubble may halt the rushed pace of the country and its capital, breaking the vicious or virtuous circle that transfers the vertigo of stock market charts to urban profiles.